The Dallas-based manager is still struggling with pricing on the properties which come across its desk.

Middle Market 50: Here are the fastest-growing midsize companies in North Texas

The Dallas Business Journal’s seventh annual Middle Market 50 list honors the fastest-growing private and public companies based in Dallas-Fort Worth with annual revenue between $10 million and $1 billion.

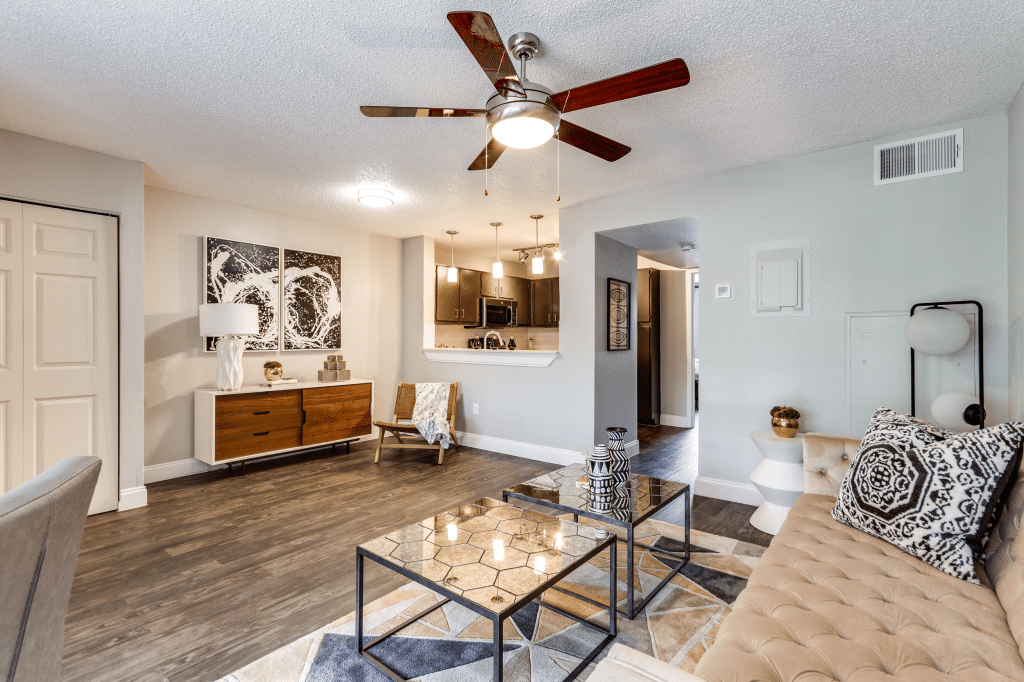

The Muse

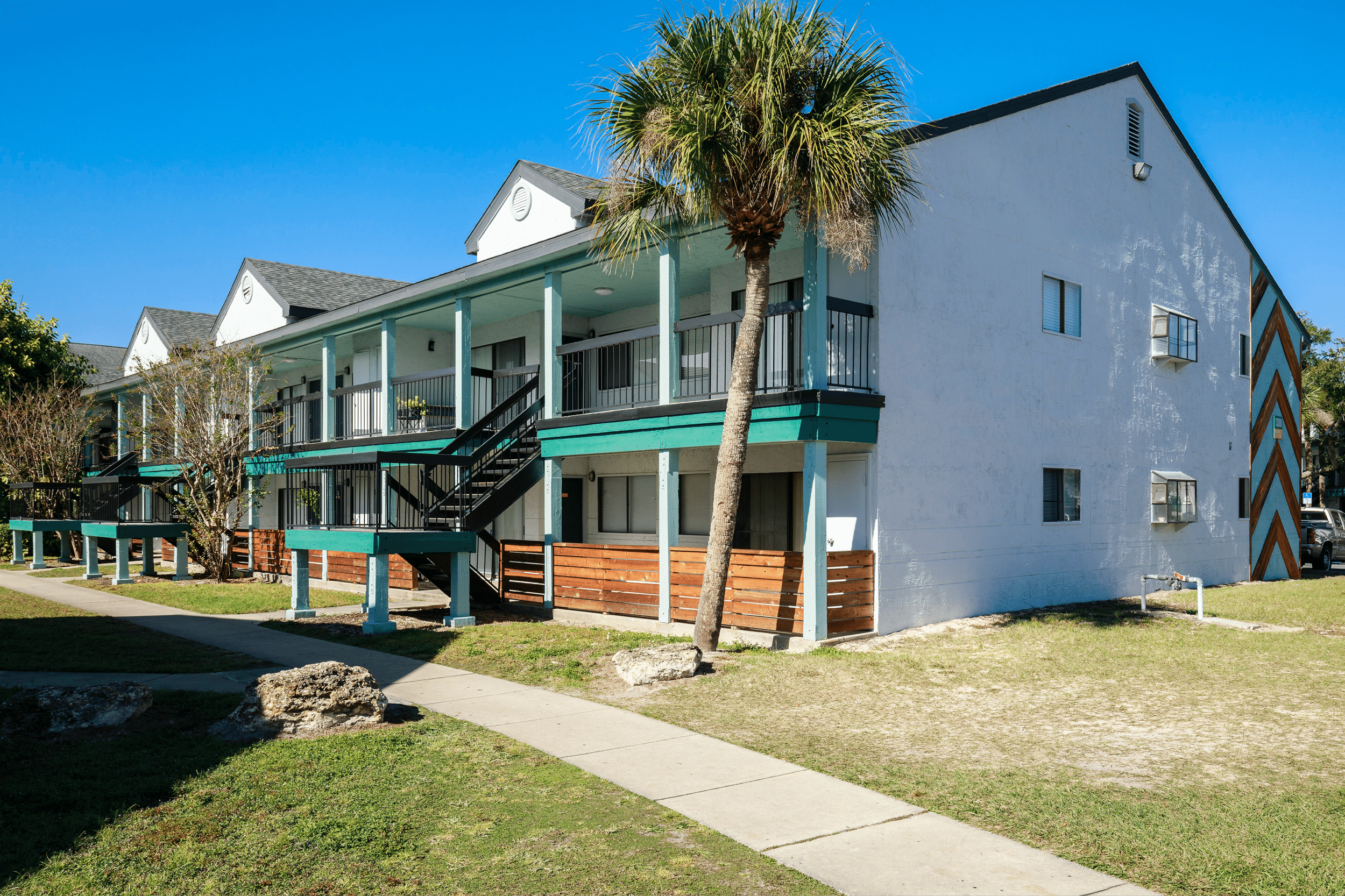

The Landing at East Mil

S2 CAPITAL BUYS FORT WORTH COMMUNITY

The 369-unit acquisition marks the investor’s 10th purchase in the Metroplex over the past year.

FCP AND S2 CAPITAL MARK THIRD DFW TRANSACTION WITH ACQUISITION OF 308-UNIT OXFORD PARK APARTMENT COMMUNITY IN IRVING

The off-market transaction marks the third deal in DFW in the last 12 months between S2 and FCP.