Boat and Shore House

S2 Capital acquired Boat House and Shore House in June 2017. Boat House and Shore House are two adjacent communities totaling 1103 units in Jacksonville, FL.

- In June 2017, S2 Capital acquired off-market a 1,103-unit community in Jacksonville, FL.

- Shore House has achieved 22% rent growth while renovating 52% of the units.

Business Plan & Execution

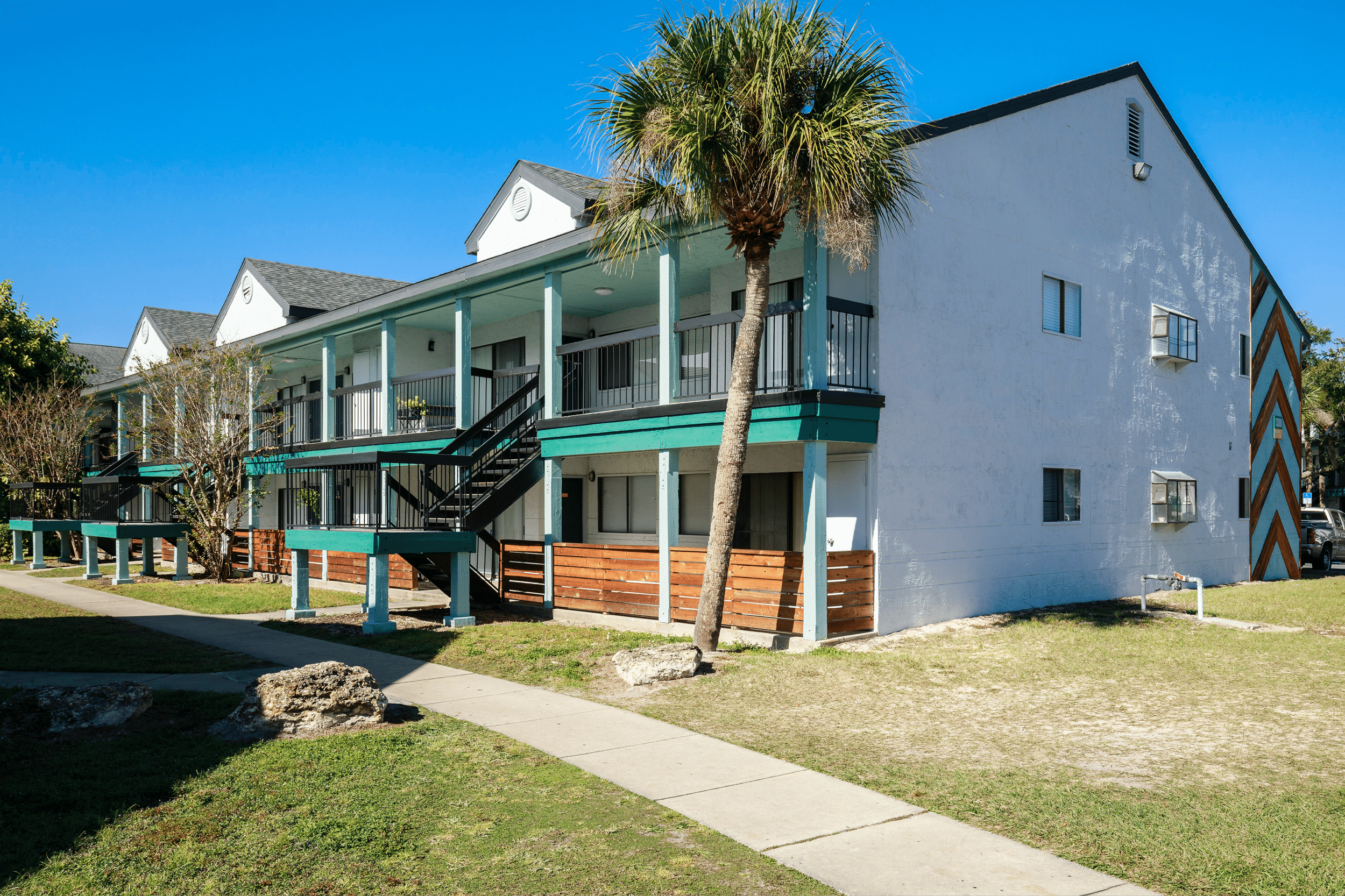

Boat House and Shore House are adjacent two-story garden style multifamily communities originally built in 1972/1973.

S2 amassed a significant presence in Florida, acquiring 5,000+ total units in Jacksonville and Orlando. Boat House and Shore House served as a continuation of S2’s push into the diverse and rapidly expanding Florida market.

S2 originally acquired the property in June 2017 and budgeted to spend approximately $12,000 per unit in renovation costs. S2 completely revamped the exteriors, implementing a new paint scheme, landscaping, and facades in addition to interior renovations.

The Jacksonville labor force grew nearly three times faster than the national average resulting in organic rent growth. S2 realized successful 22% rent increases from $572 to $700 at the time of sale. Furthermore, S2 believed the property maintained unrealized value, thus recapitalizing the deal in January of 2019.

Boat and Shore House

S2 Capital acquired Boat House and Shore House in June 2017. Boat House and Shore House are two adjacent communities totaling 1103 units in Jacksonville, FL.

- In June 2017, S2 Capital acquired off-market a 1,103-unit community in Jacksonville, FL.

- Shore House has achieved 22% rent growth while renovating 52% of the units.

Boat House and Shore House are adjacent two-story garden style multifamily communities originally built in 1972/1973.

S2 amassed a significant presence in Florida, acquiring 5,000+ total units in Jacksonville and Orlando. Boat House and Shore House served as a continuation of S2’s push into the diverse and rapidly expanding Florida market.

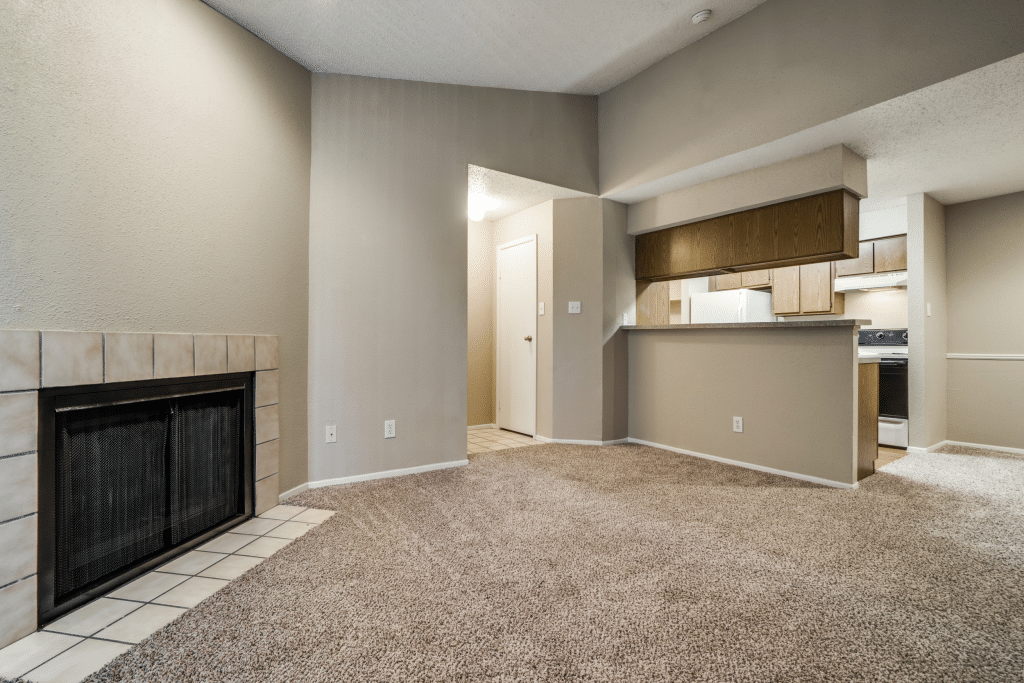

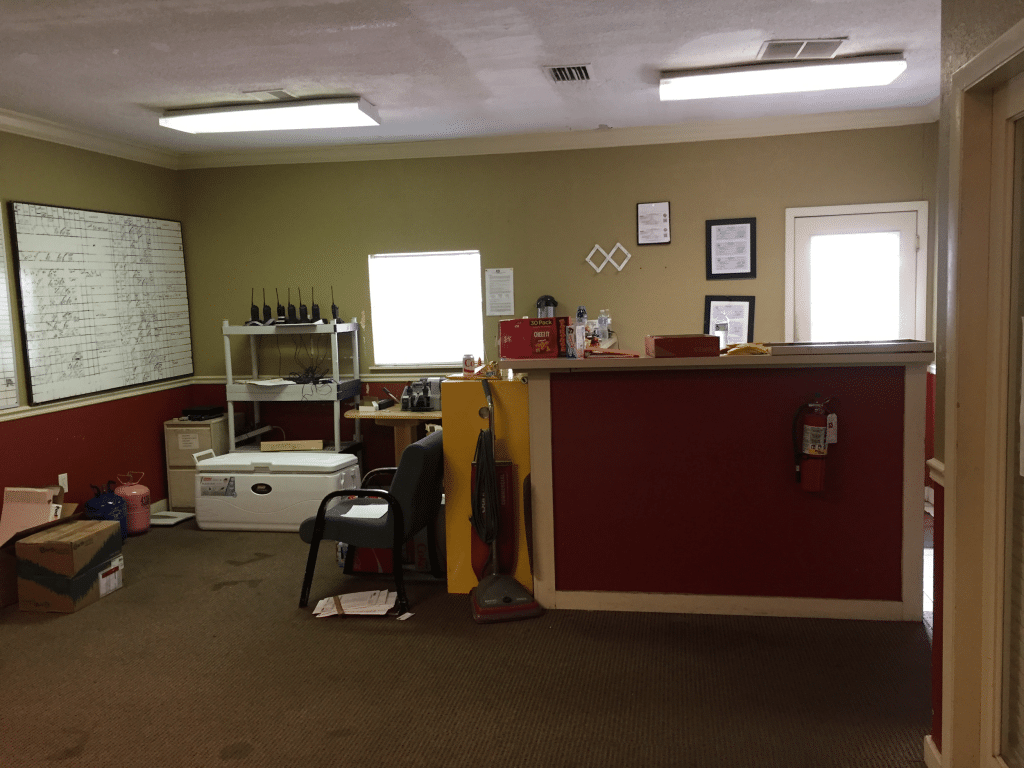

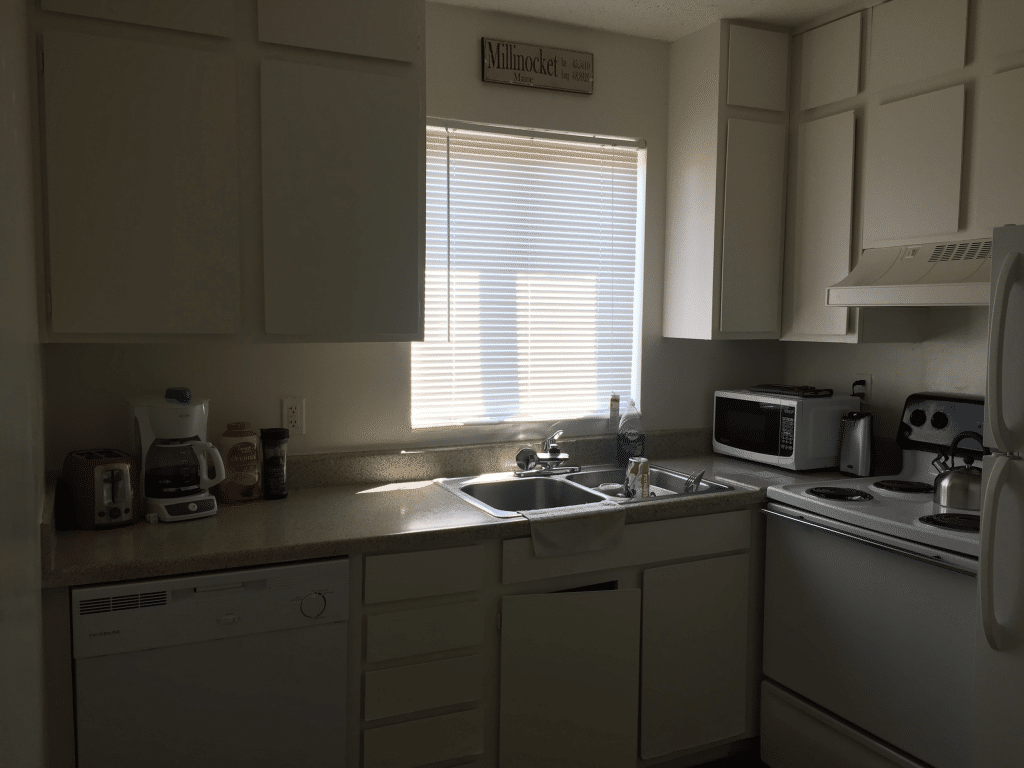

S2 originally acquired the property in June 2017 and budgeted to spend approximately $12,000 per unit in renovation costs. S2 completely revamped the exteriors, implementing a new paint scheme, landscaping, and facades in addition to interior renovations.

The Jacksonville labor force grew nearly three times faster than the national average resulting in organic rent growth. S2 realized successful 22% rent increases from $572 to $700 at the time of sale. Furthermore, S2 believed the property maintained unrealized value, thus recapitalizing the deal in January of 2019.

Boat House & Shore House

S2 Capital acquired Boat House and Shore House in June 2017. Boat House and Shore House are two adjacent communities totaling 1103 units in Jacksonville, FL.

Business Plan & Execution

Boat House and Shore House are adjacent two-story garden style multifamily communities originally built in 1972/1973.

S2 amassed a significant presence in Florida, acquiring 5,000+ total units in Jacksonville and Orlando. Boat House and Shore House served as a continuation of S2’s push into the diverse and rapidly expanding Florida market.

S2 originally acquired the property in June 2017 and budgeted to spend approximately $12,000 per unit in renovation costs. S2 completely revamped the exteriors, implementing a new paint scheme, landscaping, and facades in addition to interior renovations.

The Jacksonville labor force grew nearly three times faster than the national average resulting in organic rent growth.

S2 realized successful 22% rent increases from $572 to $700 at the time of sale. Furthermore, S2 believed the property maintained unrealized value, thus recapitalizing the deal in January of 2019.

Before

After

Key Metrics

(From June 2017 – January 2019)

Capitalization

$67,873,469

Total Equity

$17,492,469

Renovation Budget

$13,007,780

Year Built

1972/1973

Total Units

1103

Average Sqft/Unit

715 sqft

Units Renovated

52%

Starting Rent

$572

Ending Rent

$700

Rent Increase

$128

Hold Period

19 months